Most Canadian corporations know that the Canada Revenue Agency (CRA) gives out tax credits for Scientific Research and Experimental Development (SR&ED) work done by technical companies. This tax credit works out to 35% of the qualifying work and can be as high as 68% when overhead is factored in.

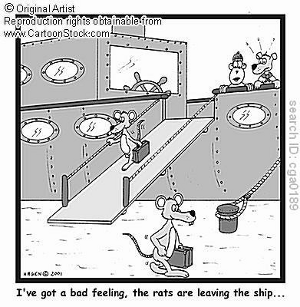

The Scientific Research part of the name makes some organizations assume that unless you are curing cancer, building rockets, or building a better mouse-trap that they must be engaged in rocket science to qualify for the tax credit — nothing could be further from the truth.

For organizations involved in software development the key to claiming SR&ED is the Experimental Development part of the title. Assuming that you have a project which has technical uncertainty then you will qualify for the tax credit.

So what qualifies as technical uncertainty?

Technical uncertainty occurs when you face a business problem that is well specified with skilled resources and it is unclear how to proceed. Examples of technical uncertainty would be needing to:

- double the number of transactions that you currently process

- increase the efficiency of an compression algorithm

- implement a security model that does not exist

Experimental development occurs when you hit a fork in the proverbial development road and it is unclear which direction to take.

Sometimes you will know that there are multiple design alternatives and have to create prototypes for the different alternatives to determine the best solution. Sometimes you will choose a design alternative and have to abandon the choice and back-up and take another path. In both cases there is a clear decision point where code needs to be tested for multiple alternatives.

There is actually an easy way to know if you are facing technical uncertainty and facilitate applying for SR&ED tax credits. Most developers do not like reinventing the wheel; when faced with a requirement that is technically challenging most developers will Google it to see if there is a solution to the problem. If your developers are regularly looking for technical solutions odds are that you have SR&ED eligible work.

Saving technical searches is the easiest way to figure out how much SR&ED eligible work you have.

If you search for a technical solution to a challenge and discover:

-

There is a solution for the problem but it is proprietary

-

There is an available solution that would cost too much to acquire

Then this work will be SR&ED eligible if it leads to experimental development. The CRA does not require that you be the first to solve a technical problem, only that you search for public solutions before executing experimental development.

What isn’t technical uncertainty?

There are a few issues which can masquerade as technical uncertainty and the CRA will not pay SR&ED credits for them:

- Training

- Poor requirements

If a COBOL programmer starts to develop software in Java then you will end up with quite a bit of experimental development as the programmer learns the new language. However, the CRA will not pay for you to train developers. Experimental development only occurs when developers who are familiar with the technologies that you are using (language, O/S, IDE, API) and then engage in experimental development.

To be explicit, the following would not qualify:

- Language, Java developers needing to do C#

- O/S, Developers familiar with Windows development developing on Android tablets

- IDE, Developers familiar with Eclipse needing to use Sun’s NetBeans

- API, Developers familiar with one SQL database switching to the API of another SQL database

Only competent developers that hit technical uncertainty and face experimental development qualify for SR&ED.

The CRA will not pay for you to figure out what your requirements are. While you are working out your “business rules” you may look like you are resolving a technical challenge as you attempt multiple alternative paths. However, creating code to solve a business problem does not qualify for SR&ED.

Changing requirements because of a technical challenge does qualify

How do I know if I did Experimental Development?

The CRA gives you up to 18 months from a fiscal year end to claim your tax credits. The problem is that if you wait this long none of your developers will remember what they did!

If your year end was March 31, 2011 then as of today (August 27, 2012) you can still claim your tax credits from 2011. The problem is that your developers will have trouble remembering what they did from March 31, 2010 to March 31, 2011.

Frankly speaking, you would be lucky to have your developers recall what they did last month. When looking back over time, there are two kinds of development that easily qualify for SR&ED:

- Work abandoned for a technical reason

- Building multiple prototypes to solve a technical problem

If you were trying to accomplish something, let’s say implementing a fine grain security model in a database and were forced to abandon the work for a technical reason then this will qualify for SR&ED. If you abandoned the work because you no longer had the requirement, i.e. a business reason, then the work would not qualify for SR&ED.

If you ran up against a technical challenge and there were multiple design alternatives that lead to multiple prototypes being tried, then the work qualifies for SR&ED. Even if the multiple design alternatives involved 3rd party software, as long as there were multiple prototypes and you had to write code then this work should qualify.

Document your technical challenges right away!

How do I Simplify the SR&ED Process?

The easiest way to simplify the SR&ED process is to track experimental development as it happens. Once your developers solve a problem and use that solution for a few months then they will forget how difficult it was to solve the problem.

There are several techniques to help in the documentation of your SR&ED claim for the next year:

- Save your technical searches

- Tag your tasks in your project management system

- Train project managers to recognize SR&ED tasks

In your project management system (JIRA, Redmine, etc) have a tag for SR&ED so that tasks can be tagged for SR&ED. As the developer or project manager discovers SR&ED tasks you can tag these tasks so that computing the hours for SR&ED next year will be easy.

In your project management system (JIRA, Redmine, etc) have a tag for SR&ED so that tasks can be tagged for SR&ED. As the developer or project manager discovers SR&ED tasks you can tag these tasks so that computing the hours for SR&ED next year will be easy.

Train your project managers to look for SR&ED tasks. Inevitably, if a developer has a task that expands for a technical reason then he will have to notify the project manager about the event. That will be the best time for the project manager to recognize SR&ED tasks and update the project management system.

Summary

All companies should make sure to have SR&ED trained people help you to make your claim. The number of companies making SR&ED claims has increased strongly in the last few years and the CRA is more strict with regards to which projects qualify.

Do not be afraid to claim your SR&ED tax credits, if you have technical challenges that involve experimental development then they are yours. Also, keep in mind that the earlier that you document your technical challenges the easier (and cheaper) it will be to make your SR&ED claim.

You must log in to post a comment.